#4: High stakes, and pricier imports

China and The Philippines race for oil in the South China Sea, while Malaysia grapples with rising import prices.

Welcome to this week’s edition of SEAmplified! Your latest insights on Southeast Asian politics in 7.3 minutes.

⌛This week in brief:

📌 The Philippines bets on alliances to tap South China Sea oil

📌 Malaysia's economy rattled by pricier imports 📅 Explainer of the week

Energy: Philippines to conduct energy exploration in the South China Sea amidst China tension

📌 The Philippines is leveraging on defense alliances to unlock access to oil in the resource-rich South China Sea.

📌 The move is part of a bid to reduce reliance on fuel imports, and comes amid news that key local reserves are depleting.

📌 While it may provide respite to the Philippines’ energy crisis, oil exploration in the South China Sea could be a potential flashpoint. What’s going on here?

The Philippines plans to pursue defense alliances with the U.S. and other partners to aid in its efforts to explore oil and gas resources in the South China Sea.

While it will help the country meet increasing energy needs, China has warned against attempts to undermine its political, economic and security interests in the area, and criticized the U.S. for inciting unrest in the region by containing China.

What does this mean?

The Philippines is heavily reliant on imports for fuel consumption.

From January to June 2023, the country imported 75.2% of its gasoline demand, 73.8% of its diesel demand, and 93.1% of its liquefied petroleum gas demand.

Malampaya, the country’s domestic natural gas field, is expected to run dry by 2027.

It is estimated that the South China Sea holds about 190 trillion cubic feet of natural gas and 11 billion barrels of oil, with many more undiscovered

Philippines President Ferdinand Marcos Jnr has expressed his country’s desire to exploit energy reserves in the area, as it tries to reduce its reliance on coal and fossil fuel

China and the Philippines have been negotiating for a joint exploration of oil and gas in the area since January 2023.

However, repeated clashes between Chinese and Filipino coast guard vessels near the contested Second Thomas Shoal have stalled discussions.

From Manila’s point of view, China’s posture has become increasingly forceful over time. Efforts to negotiate joint exploration of oil and gas resources in the area have made little progress.

Meanwhile, Beijing has stressed its commitment towards settling disputes through negotiation and consultation, and reiterated that The Philippines’ military cooperation should not transgress China’s interests in the South China Sea.

Why should I care?

Personally: Keeping the lights on

The Philippines is on the verge of an energy crisis, as energy shortages have pushed up electricity prices.

It was reported that the Philippines has the second most expensive electricity prices in Southeast Asia after Singapore at US$9.86 per kWh, based on data from January 2022.

Another report cites high imported fuel costs as the reason for the rise, with Filipinos taking to social media to voice their displeasure.

Rising electricity demand has stressed the country’s power grid, which desperately needs an upgrade.

The Philippines power grid operator is now in hot water for failing to prevent an outage over the New Year’s holiday.

It has also been accused of resorting to reducing power supply for certain areas to prevent a complete nationwide outage.

Energy exploration in the South China Sea is perhaps a way to mitigate the energy crisis.

The bigger picture: A step closer to igniting the powder keg?

Already fraught with tensions, the South China Sea could become a potential flashpoint as energy exploration efforts risk additional confrontation.

Both China and the Philippines have stressed that any joint exploration must recognize their right to exploit resources in the area, and both have accused each other of serving their own interests at the expense of regional stability.

China has also accused the US of supporting The Philippines’s efforts to “contain” China. It alleges that the US - Philippines Mutual Defense Treaty, in applying to any attack on Filipino targets in the South China Sea, risks escalating a regional quarrel into global war.

📅 Explainer of the week

Energy: F&B, Electronics, Chemicals: surging Malaysia import costs amid Red Sea crisis

📌 Escalating Houthi attacks in the Red Sea have caused delays and raised prices of European imports into Malaysia.

📌 These effects could hinder domestic production, drive up inflation, and also reduce demand for Malaysian exports.

📌 As Southeast Asia becomes more integrated into global value chains, the region must contend with new opportunities and risks.What’s going on here?

As Houthi attacks in the Red Sea escalate, more commercial vessels are taking a longer, more expensive route around Africa. That has caused import delays and raised Malaysia’s import costs, as container shipping rates, which soared sixfold over the Gaza crisis, surged even higher.

What does this mean?

Roughly 30% of global container trade passes through the Suez Canal.

While attacks carried out by Houthi militants on civilian vessels in the Red Sea began as early as 2015, these attacks intensified after the group announced that it would target all ships heading to Israel on Dec 9, 2023.

Since the escalation, at least 27% of global container shipping has been rerouted away from the Red Sea and around Africa. These trips typically take 25% longer than using the Suez Canal.

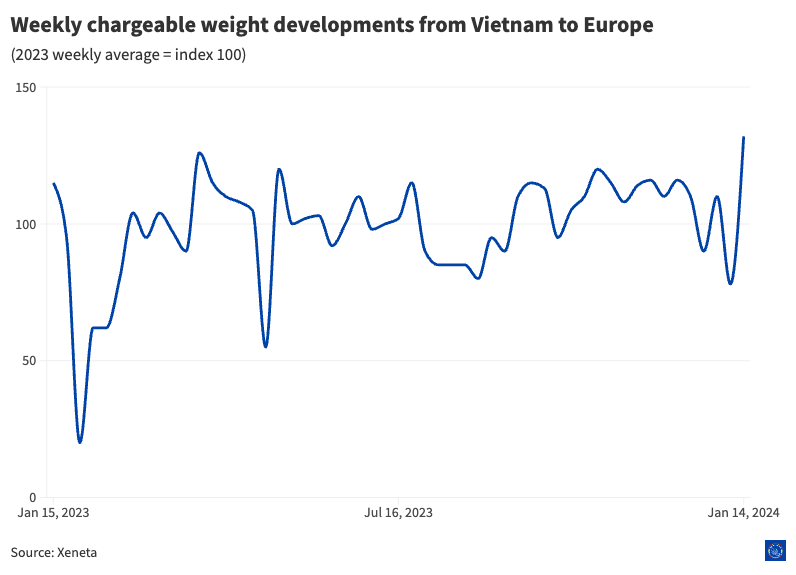

As more ships avoid the conflict-prone area, short-term container shipping rates have increased a whopping 147%, from US$1671 per container in Dec 2023 to US$4136 per container in Jan 2024.

Earlier, Asia-Europe container shipping rates had skyrocketed more than sixfold since the outbreak of war in Gaza. The escalating violence in the Red Sea pushes prices up even higher.

For Malaysia, this has significant consequences:

Imports from Europe are taking nearly two weeks longer to reach Malaysia’s ports. These delays could slow production on the country’s chemicals, machinery, and auto sectors, which rely on Europe for key imports.

The higher cost of imports could also drive domestic prices up, potentially worsening inflation. This issue comes amid the Malaysian government’s plans to restructure subsidies.

Demand for Malaysian exports could take a hit as well.

Why should I care?

Personally: How far will prices stretch?

Shipping firms and local firms affected by higher import costs are passing these expenses onto consumers, and it’s not just Malaysians who are feeling the pinch.

For now, the impact of more expensive imports is clearest among luxury goods imported from Europe - cars, cheeses, wines among them.

But as import delays persist, local companies in affected industries may need to fork out more to procure parts at a premium, or seek out alternatives to get the materials they need to run their businesses. This could also increase the price of other, perhaps more essential, goods.

It should be noted however, that only 22% of ASEAN exports are headed to the US and Europe in 2022, with the majority (37.7%) being intra-ASEAN and to China.

The impact of more expensive exports to Europe varies across Southeast Asia, with Vietnam's exports to Europe, for example, already surpassing pre-COVID levels as of January 14 this year.

The bigger picture: Can ASEAN ride out global tradewinds?

Between 2012 and 2021, intra-ASEAN trade in tangible, physical goods grew just 17.3%,

By comparison, extra ASEAN trade in the same category of goods increased 40.2% during the same period.

As a percentage of total trade, intra-ASEAN trade actually fell from 24.4% in 2012 to 21.3% in 2021. As of June 2023, intra-ASEAN trade has also not returned to its pre-pandemic share of 24%.

As trade between the ASEAN bloc and foreign partners outpaces intra-regional trade, the region faces new opportunities and risks.

As of 2022, roughly 27% of goods produced in the ASEAN bloc rely on materials imported from other countries; 25% of goods produced in the ASEAN bloc are sent to other countries to create other products.

At the same time. Southeast Asia is also seen as an attractive destination for firms looking to minimize their supply chain dependencies on China.

Community feature

Organized crime is a persistent problem for Southeast Asia, as a report released this week by the UN Office on Drugs and Crime (UNODC) reveals.

The report is a hefty 105 pages long. Thankfully, digital consultant Su Woongsik has a quick summary. He highlights key insights into East and Southeast Asia’s drug development, money laundering, and illicit banking businesses, and how this underground economy is evolving.

Read the full post and report here.

News roundup

Indonesia records a total of 222 million and 194.7 million downloads for finance and personal loan and VPN apps respectively, as digital consumers leverage on the convenience of apps to access banking services and to bypass strict Internet regulations.

Vietnam has partnered with the U.K to tackle human trafficking through increased information exchange and greater support in training and capacity building for border guard officers.

Thailand has discovered nearly 15m tonnes of lithium. The discovery comes amid the country’s efforts to become a regional electric vehicle (EV) production hub.

Thailand’s EV sales are expected to double following a demand boom driven by nearly $2.4 billion in government incentives.

Malaysia faces a potential “brain drain” in the healthcare sector. Grueling hours, poor pay, and ineffective human resource management are key reasons for the exodus of talent.