#3: Closer ties and bitter squabbles

Indonesia cosies up to Vietnam, while Filipinos working abroad butt heads over Gaza.

Welcome to this week’s edition of SEAmplified! Your latest insights on Southeast Asian politics in 6.5 minutes.

⌛This week in brief:

📌 Indonesia, Vietnam forge closer trade ties

📌 Overseas Filipinos butt heads over Hamas-Israel conflict 📅 Explainer of the week

Electric vehicles, agriculture, education, tourism: Indonesia, Vietnam forge closer ties with more trade, investments in EV and cooperation

📌 Indonesia and Vietnam are ramping up investments in each others’ economies, with Vietnamese investments into Indonesia’s electric vehicles (EV) market taking the lead.

📌 Both countries, among Southeast Asia’s fastest-growing economies, aim to become highly-developed countries by 2045.

📌 Closer ties between the two countries is a step forward for regional integration in Southeast Asia. What’s going on here?

In a meeting in Hanoi on Jan 12, 2024, Indonesian and Vietnamese leaders agreed to boost bilateral trade to US$15 billion by 2028. To do so, the two countries will work closer together in areas such as agriculture, education, fisheries, and tourism. Both countries have also agreed to boost security in the South China Sea.

At the same time, Vietnam’s electric vehicle (EV) maker VinFast also pledged a US$1.2 billion investment in Indonesia. The company did not specify how long its investment horizon was.

What does this mean?

Vietnam and Indonesia are Southeast Asia’s fastest-growing economies. Both recorded an average growth of 6-8% from 2018 to 2022.

Within ASEAN, Indonesia is Vietnam’s third-largest trading partner, while Vietnam is Indonesia’s fourth-largest trading partner. Bilateral trade has increased from US$9 billion in 2019 to nearly US$14 billion in 2023.

In 2021, exports from Indonesia to Vietnam reached US$7.1 billion, while exports from Vietnam to Indonesia reached US$4.09 billion.

The desire to boost ties is significant, as both countries aim to become high-income developed economies by 2045.

Both leaders have acknowledged the need to enhance dialogue and elevate economic cooperation to match strong political ties.

At the same time, VinFast’s investments comes as Indonesia relaxed tax rules on EV imports to attract investment.

Indonesia aims to reduce transport emissions and develop its EV industry with a target of producing 600,000 EVs by 2030.

VinFast’s plans to build an EV manufacturing plant in Indonesia with a projected production capacity of up to 50,000 vehicles annually will be a boost to Indonesian efforts.

Why should I care?

Personally: New opportunities in the EV industry

VinFast’s bet on Indonesia could signal bigger things to come.

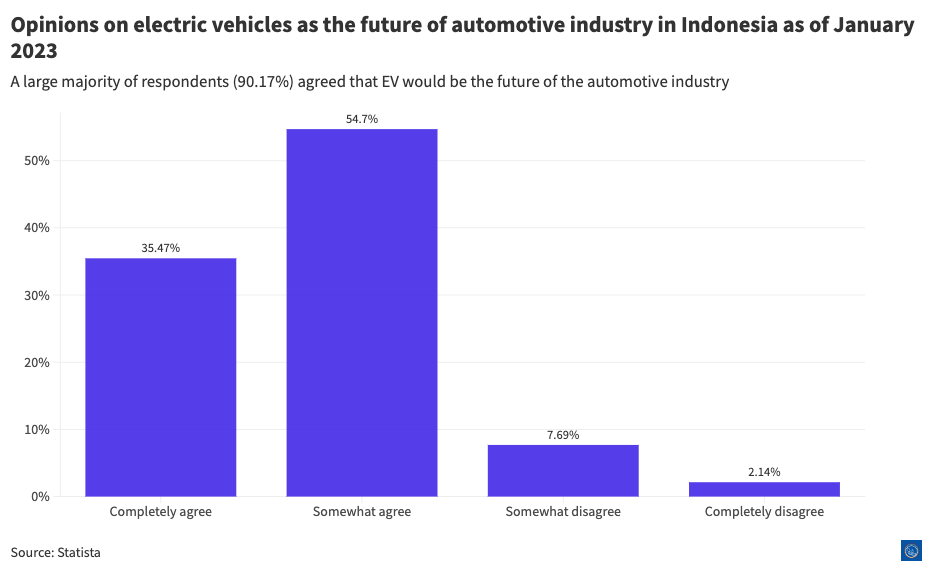

90.2% of Indonesian respondents agreed that EV would be the future of the automotive industry.

A potential boom in Southeast Asia’s EV industry is looming, with infrastructure such as charging stations, factories, and showrooms emerging across the region in anticipation of growing demand.

The data doesn’t lie: EV sales in Southeast Asia grew 894% year-on-year between Q2 2022 and Q2 2023, driven by strong demand in Indonesia, Malaysia, Thailand, and Vietnam. New opportunities in the EV industry.

The bigger picture: Deepening regional economic integration and ASEAN centrality

More importantly, the call for closer ties between Indonesia and Vietnam takes the ASEAN bloc a step closer to realizing the ASEAN Economic Community (AEC): a single, highly competitive region with a key role to play in the global economy.

Conceptualized in 2015, the AEC’s vision has been fraught with obstacles: gaps in income, infrastructure, and institutions have resulted in unequal development across Southeast Asia, making it difficult for the entire region to function as one united economic entity.

Indonesia and Vietnam’s agreement to expand cooperation in artificial intelligence, digital economy and green economy could be a positive step in addressing challenges of the AEC.

📅 Explainer of the week

Domestic care: In Israel - Gaza conflict, a clear divide between Filipino migrant workers

📌 Overseas Filipino Workers that previously worked in Israel and across Arab countries are divided on their stance towards the ongoing conflict between Hamas and Israel.

📌 This division deviates from Manila’s support for Israel, and has added a socio-economic division to disagreements back home in The Philippines.

📌 The conflict could hint at how greater geopolitical risk worldwide could adversely affect remittance flows to Southeast Asia and derail a crucial economic growth engine for the region. What’s going on here?

While the Philippines officially supports Israel in the ongoing conflict, that support isn’t unanimous among Overseas Filipino Workers (OFW).

Distributed across both Israel and the Arab world, these migrant laborers are typically employed as domestic caregivers and low-skilled labor in the agriculture, construction, and hospitality sectors. They absorbed different narratives from their host countries and, consequently adopted opposing perspectives on the war between Israel and Hamas.

What does this mean?

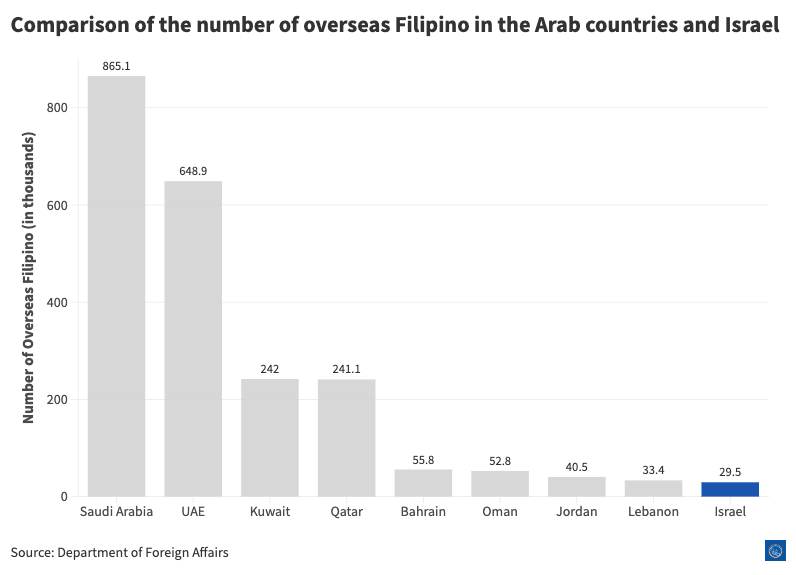

Prior to the conflict between Israel and Hamas, nearly 30,000 and 1.07 million Filipinos were working abroad in Israel and Arab countries respectively as OFWs.

In some cases, these OFWs or their countrymen back home also had family members based in Israel or the Gaza strip.

As the conflict intensified, so did the division between OFWs’ responses to it. Protests against Israel’s actions in Palestine have been largely led by civil society, migrant workers, and students.

This split deviates from the official position that Manila has taken on the Israel - Hamas conflict. The Philippines is the only Southeast Asian country that has abstained from a UN resolution calling for a humanitarian truce in Gaza.

Why should I care?

Personally: The real value of working abroad

While many OFWs seek better wages overseas, working abroad can also be beneficial to improving soft skills and broadening cultural intelligence.

The experience of working abroad, or even just visiting another country, can also provide one with a more informed view of global developments.

Case in point: Americans who visited at least one country outside of the US scored higher on the Pew Research Center’s international knowledge scale compared to their peers who have not traveled abroad before.

In Southeast Asia, the idea that travel broadens perspectives is more pertinent than ever: media freedom remains low across the region, and access to contrarian viewpoints is narrowing.

The bigger picture: Southeast Asia’s remittance economy frays as geopolitics heats up

Southeast Asia banks big on remittances from their overseas workforces:

Comprising just 2% of The Philippines’ total population, OFWs remitted nearly US$36.1 billion - 8.9% of The Philippines’ Gross Domestic Product (GDP) - in 2022.

Indonesia, The Philippines, and Thailand are ranked among the world’s top 15 remittance receiving countries by remittance inflows as a percentage of their GDPs; A 2022 World Bank study found that Vietnam placed third in terms of remittance inflows across East Asia and the Pacific.

As geopolitical volatility intensifies worldwide, foreign remittance inflows into Southeast Asia could take a hit.

Case in point: higher geopolitical risk has caused Southeast Asian currencies to depreciate, and higher geopolitical risk also induces greater volatility in remittance flows to the region.

That said, some other studies suggest that geopolitical risk and foreign remittances don’t always move in opposite directions.

Community feature

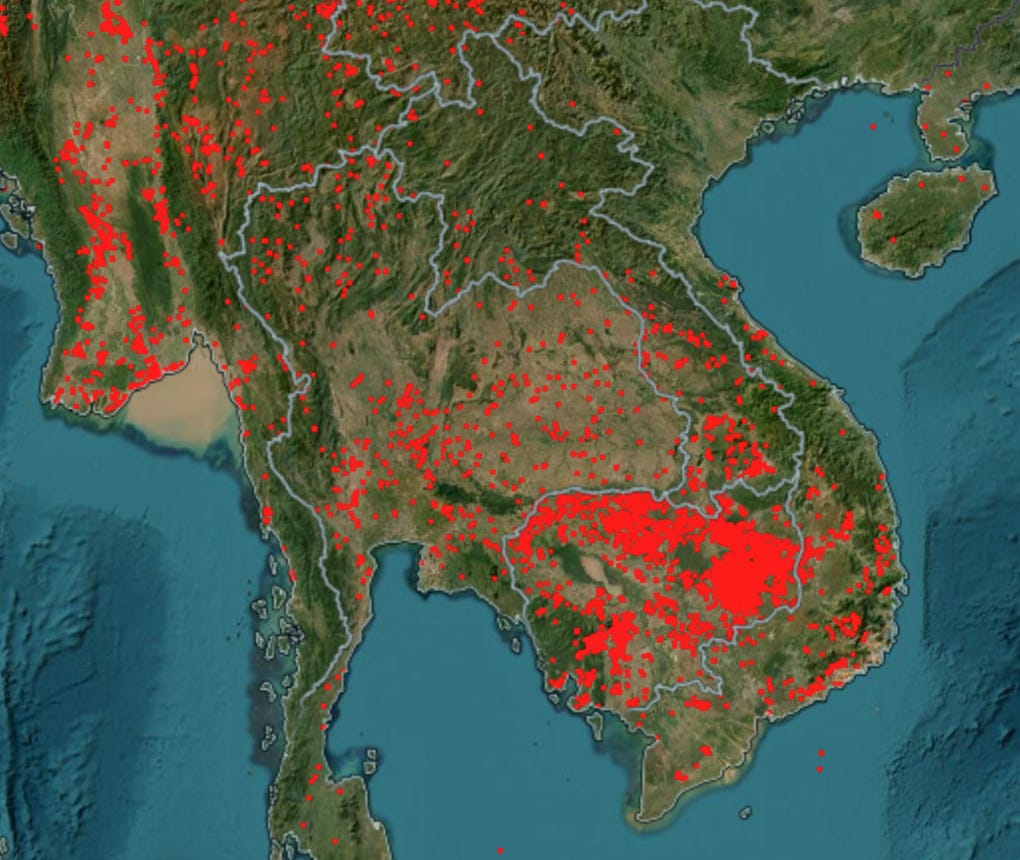

Transboundary haze is a perennial issue between Singapore and Indonesia, but NASA’s data, taken on Jan 13, 2024, shows that these countries are not the only ones finding it difficult to breathe.

As Reuters Fellow and Chevening Scholar Pravit Rojanaphruk reveals, active fires are all over Cambodia, Laos, Myanmar, and Thailand. Just last year, the city of Chiang Mai struggled to rein in severe haze pollution from unabated slash-and-burn agriculture and man-made forest fires.

These conflagrations have serious effects on public health: 2020 data from the University of Chicago’s Air Quality Life Index estimated that haze pollution shortens life expectancy across Southeast Asia by 1.2 to almost 5 years across various cities.

News roundup

Indonesia, Vietnam are aiming to hit US$15 billion trade turnover in 2024, up from US$14 billion in 2023, as leaders from both countries seek to bolster cooperation over a wide range of industries.

Singapore, Malaysia have signed a deal to set up a special economic zone in Johor, with passport-free access at land checkpoints being explored.

Philippines President, Ferdinand Marcos Jr, claims that the country has recovered from the pandemic and global conflict shocks, after a 6.1% growth in the third quarter of 2023.

Thailand's Ministry aims to curb oil and electricity prices as it significantly exceeds the prices of Indonesia and Vietnam.

Vietnamese workers from 8 localities have been re-accepted into a program to work in South Korea, after a temporary ban in 2023 due to illegal overstays.