#2: Chinese travelers and mass layoffs

A Thai-Chinese visa vaiver is on the horizon, while Indonesia's export industries shed jobs

Welcome to this week’s edition of SEAmplified! Your latest insights on Southeast Asian politics in 6.8 minutes.

⌛This week in brief:

📌 Thai-Chinese mutual visa waiver to take effect from March 2024

📌 A wave of layoffs sweeps over Indonesia's key export industries📅 Explainer of the week

Travel, F&B: Thailand, China to waive visas for each other's citizens from March 2024

📌 Thailand and China permanently waived visa-free requirements for each other’s citizens from March 2024

📌 Thailand, heavily reliant on tourism, is eyeing Chinese travelers as a lifeline for its tourism industry.

📌 Despite past worries on “zero-dollar tours”, tourist appetites have changed and this announcement is part of efforts to promote Sino-ASEAN cooperation.

What’s going on here?

China and Thailand have agreed to permanently waive visa requirements for each other’s citizens, The mutual waiver will kick off in March 2024, though it should be noted that Thailand had waived visa requirements for Chinese tourists earlier in September 2023.

This comes after Brunei, Singapore, and Malaysia reached visa-free agreements with China in the last few months. Following the announcement, Chinese enquiries for travel to Thailand have surged 158%.

What does this mean?

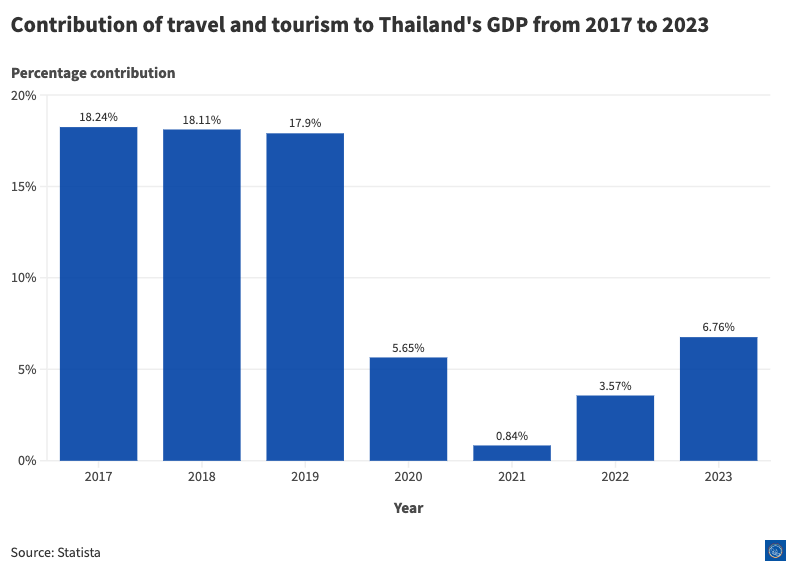

Prior to COVID-19, tourism comprised a significant 17% to 18% of Thailand’s Gross Domestic Product (GDP) and employed nearly 11% of the Thai workforce.

Chinese travelers were also the country’s top source of inbound tourists since 2012, but overall figures for Chinese arrivals slipped to second place in 2023 over human trafficking and public safety concerns.

Thailand’s tourism industry remains in the doldrums, and Thai Prime Minister Srettha Thavisin has seen the writing on the wall. He plans to attract 35 million foreign tourists in 2024. 8.2 million of them - 23.4% of the overall figure- are projected to be Chinese tourists.

To do so, Thailand has introduced new airlines and approved tax cuts on alcoholic beverages and entertainment venues to enhance Thailand’s appeal as a premier tourist destination. Amplifying these moves is the visa-free policy, which is expected to increase cross-border travel between China and Thailand, and revive the Thai tourism sector.

Why should I care?

Personally: A chance to reinvent Thailand’s travel scene

Prior to COVID-19, most Chinese tourists visited Thailand on “zero-dollar tour groups.” These tours brought tourists to specific spots run by Chinese operators to spend money, which hindered the flow of benefits to the local economy.

Not only do “zero-dollar tour groups” not benefit the local economy, they also damage the reputation of Thailand’s tourism operators by forcing tourists to purchase low-quality goods and services.

While the Thai authorities have clamped down on these practices since 2016, that hasn’t stopped the return of “zero-dollar tour groups.”

What’s changed: younger, savvier Chinese tourists are veering away from group travel, with many of them turning to social media apps like Douyin and Xiaohongshu for travel planning and booking.

As Chinese traveler preferences evolve, travel companies in Thailand have an opportunity to rebuild the tourism supply chain in ways that are mutually beneficial to both Chinese tourists and local businesses.

The bigger picture: Bringing people across China, Southeast Asia closer

Thailand joins Brunei, Malaysia and Singapore in the list of visa-free agreements with China, and more countries are expected to be part of the initiative.

2024 has also been designated as the “ASEAN-China Year of People-to-People Exchanges”.

In a statement, ASEAN countries have welcomed the designation to foster cooperation in culture, education, youth, tourism and deepen people-to-people ties.

The Chinese Foreign Ministry has also outlined plans for youth, grassroots, education, culture and sports, media, entrepreneurial, local and governance exchanges with ASEAN countries for 2024.

This comes as ASEAN and China are recovering their economies from the Covid-19 pandemic, and the initiative is said to be “capitalizing on the momentum”.

📅 Explainer of the week

Manufacturing: Waves of lay-offs sweep Indonesia’s export-oriented industries in 2023

📌 Significant numbers of Indonesian workers were laid off last year, with the majority of them coming from the country’s textile and footwear industries.

📌 Weak demand from Europe, a rise in Illicit imports,” and poor cost-efficiency in the manufacturing sector are to blame.

📌 The trend could hint at the bigger threat of premature deindustrialization - and a missed opportunity for Indonesia to capitalize on its young population. What’s going on here?

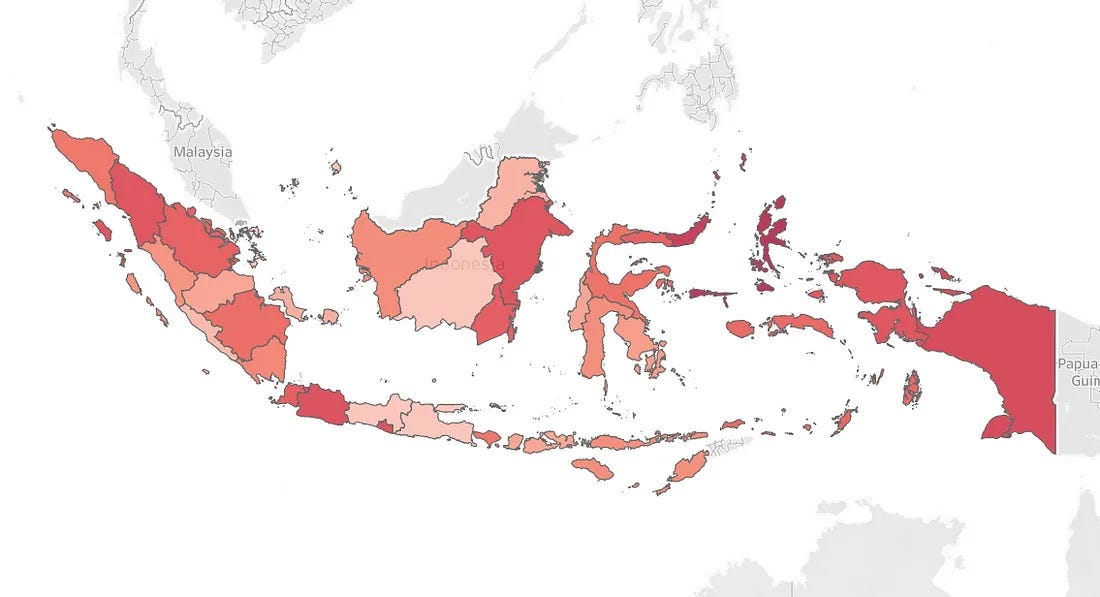

More than 295,000 Indonesian workers were laid off between January and November 2023. Most of the layoffs came from the textile and footwear industries, with slightly over 56% located in West and Central Java.

Provinces that depended on commodity exports, like East Kalimantan for coal and Central Sulawesi for stainless steel, were also affected.

What does this mean?

The layoffs came off the back of weaker demand in Europe - a key export market for Indonesia. Additionally, buyers are also turning to other countries like Malaysia, Vietnam, and China for cheap, mass-manufactured goods.

What is implied in the switch towards other markets is that Indonesian manufacturing is not as cost-efficient.

In 2022, the Indonesian Employer Association counted nearly one million workers laid off from their jobs. Besides dropping export demand, the organization also attributed the job losses to the proliferation of illegal goods that circumvent taxes and import duties, and factory automation.

Why should I care?

Personally: Calling for educators

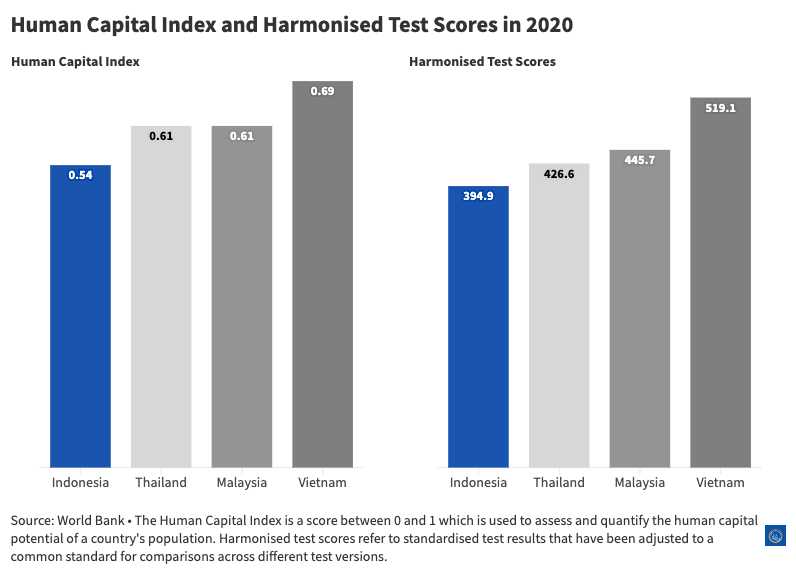

The workers affected by these mass layoffs will require upskilling or retraining, and so does much of Indonesia’s working population.

42% of 25 to 34 year-olds in Indonesia have not attained an upper secondary qualification. As of 2023, only 4% of Indonesians are enrolled in tertiary-level programs.

OECD estimates suggest that by 2030, nearly 113 million Indonesians - 41% of the current population - will need retraining.

The underlying problem: Indonesia is still struggling with a low average quality of education, and education accessibility remains unequal across various provinces.

As of 2020, Indonesia’s Human Capital Index stood at 0.54. Malaysia and Thailand both registered 0.61 while Vietnam scored 0.69 that year.

To address this, the Indonesian government is incentivizing private investments into the country’s higher education sector, and encouraging the growth of the educational technology (edtech) sector.

The bigger picture: Deindustrialization and a narrowing window of opportunity

These mass layoffs are also symptomatic of deindustrialization in Indonesia, and add pressure on Indonesia to step up its efforts to capitalize on its demographic dividend.

Indonesia’s GDP share of manufacturing has persistently declined since 2005, and COVID-19 accelerated this trend by compelling business shutdowns and more rapid adoption of automation solutions.

A strong manufacturing base would allow Indonesia to move up the value chain, away from low value-added sectors, and encourage the development of higher-value manufacturing activity.

Instead, Indonesia’s economy is moving away in two opposing directions. On one hand, it’s already transitioning to the service sector. On the other hand, many factory workers returned to agriculture as a result of business closures during COVID-19.

This situation serves as the backdrop for the upcoming presidential elections in Indonesia, which sees candidates mostly addressing bread-and-butter issues such as job creation, socioeconomic inequality, and equitable growth.

Community feature

Electoral violence is commonplace in Southeast Asia, and Indonesia is no exception. To determine which provinces are most susceptible to conflict, Tangerang-based Audhi Aprilliant tapped on the Indonesian General Election Supervisory Agency’s General Election Vulnerability Index - and yielded some surprising results.

Read his full analysis here.

News roundup

Vietnamese students have been advised by experts to prepare for Australia and the UK’s tougher visa policies, citing an impact on those who lack outstanding skills.

Vietnam has reported a 6.9% growth in average workers’ income in 2023, but the country’s General Statistics Office added that its labor market quality has yet to improve due to the large portion of informal workers.

Malaysia’s social media users have hit back at a McDonald’s franchisee’s lawsuit against a pro-Palestinian boycott movement. McDonalds' Malaysian license holders have also sued the boycott movement for brand damage.

Singapore’s National Trade Unions Congress expressed its disappointment over ecommerce major Lazada’s decision to lay off “an undisclosed number” of its Singapore staff, saying that it was not informed. The fresh round of layoffs has also impacted employees in Indonesia, Malaysia, and Vietnam.

Malaysia’s Johor state government has proposed making Iskandar Malaysia a designated special economic zone with Singapore. Presently, Singapore is now the project’s second largest investor.