#1: Growth doldrums and rail dilemmas

The ADB cuts Southeast Asia's growth forecasts, and Hanoi ponders its prospects over the Fangdong Railway.

Welcome to this week’s edition of SEAmplified! Your latest insights on Southeast Asian politics in 6.7 minutes.

⌛This week in brief:

📌 Southeast Asia growth forecasts slashed on weak manufacturing output

📌 China's Fangdong railway: boon or bane for Hanoi? 📅 Explainer of the week

Manufacturing: ADB lowers SEA outlook on weak 2024 output

📌 The ADB has downgraded growth projections for Southeast Asia for 2023 and 2024, highlighting a manufacturing decline in Malaysia, Thailand, and Vietnam as a key reason for the slowdown.

📌 Amid weak global macroeconomic conditions and high material costs, some bright spots could soften further decline in 2024.

📌 A potential Southeast Asian rebound could depend on balancing economic ties between China and the US. What’s going on here?

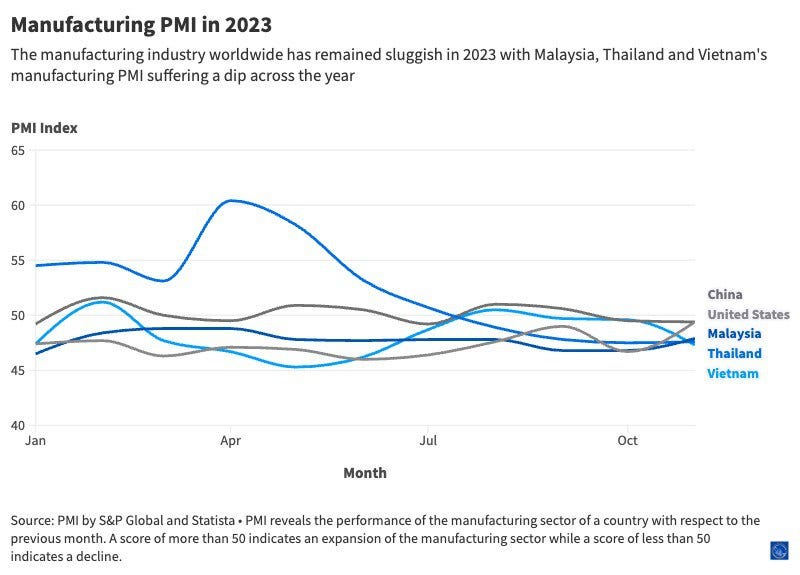

The Asian Development Bank’s “Asian Development Outlook” for Dec 2023 has revised growth forecasts for ASEAN down from 4.6% to 4.3% for 2023 and 4.8% to 4.7% in 2024. A key drag on the regional outlook: “lackluster performance” in the Malaysian, Thai, and Vietnamese manufacturing sectors.

All three countries have reported a Purchasing Manager Index (PMI) below 50 as of Nov 2023, suggesting a decline in manufacturing activity.

What does this mean?

The “lackluster performance” is due to various reasons.

Demand for Vietnamese and Indonesian star exports like textiles and garments has dipped due to high inflation in key export markets like the US and high input costs at home.

Thai electronics and agricultural goods are feeling the chill from weak economic conditions in China and Japan.

That said, the smaller dip in 2024 suggests some bright spots are on the horizon.

China and India have filled the gaps in Indonesian and Malaysian palm oil exports created by new EU sustainability rules.

Philippine manufacturing, among the fastest-growing worldwide, could also leverage on the country’s geostrategic significance to break into higher-value activities in the semiconductor and electronic data processing segment.

Why should I care?

Personally: A time for aerospace, semiconductor manufacturing to shine

While the ADB is less optimistic on Southeast Asia’s overall growth, opportunities could persist in the region’s aerospace and semiconductor manufacturing segments.

Case in point: Singapore’s aerospace segment grew 14.8% with higher demand for aircraft parts, maintenance and repair services, while Malaysia’s aerospace exports also grew 10.1% between the first eleven months of 2023 compared to 2022.

Aviation major Boeing also estimated that there’s room for Southeast Asia’s commercial airplane fleet to quadruple by 2042, and is betting that the region will be its fastest-growing single-aisle airplane market between 2022 and 2042.

Semiconductors, another bright spot amid Southeast Asia’s manufacturing doldrums, could also benefit with the influx of foreign investment. GPU giant Nvidia has already announced plans to set up shop in Vietnam, and a Taiwanese affiliate of chip giant TSMC is also mulling an overseas expansion in Singapore.

The bigger picture: SEA’s export links with China and the US, and potential economic balancing?

Both China and the US are the Association of Southeast Asian Nations’ (ASEAN) key trading partners (China being the largest since 2009).

But while regional countries acknowledge their economic significance, they’re unwilling to take either side.

A report published by the ISEAS - Yusof Ishak Institute indicated that 38.6% of respondents were concerned with China’s expanding political influence, and 33.9% are worried that the US-led Indo-Pacific Economic Framework (IPEF) will worsen Sino-US rivalry.

As Sino-US rivalry intensifies, countries in the ASEAN bloc increasingly seek a trade balance with both powers.

The Philippines is exploring semiconductor supply chain opportunities under the US’s International Technology Security and Innovation Fund while keeping China as its top trading partner

Thailand is grappling with balancing its growing economic reliance on China and US international security concerns.

📅 Explainer of the week

Travel, Logistics: China's Fangdong railway puts cross-border links in Hanoi's court

📌 China has announced a new railway link between Fangchenggang and the Sino-Vietnamese border city of Dongxing.

📌 This a first step towards closer trade cooperation, and could also facilitate a travel boom in Vietnam’s Quang Ninh province.

📌 But Vietnam’s about-face also raises questions over whether the country is being strong-armed into changing its stance on the project. What’s going on here?

Following Chinese president Xi Jinping’s recent visit to Hanoi, China has begun operations on the country’s first high speed railway connecting a border city with its national rail network.

This connection builds upon an agreement to boost ties and build a “shared future”, despite long-standing friction between the two neighbors over historical animosities and disputes in the South China Sea.

What does this mean:

Sino-Vietnamese border trade at the land border crossings is big business for Chinese and Vietnamese border provinces, and both countries know that.

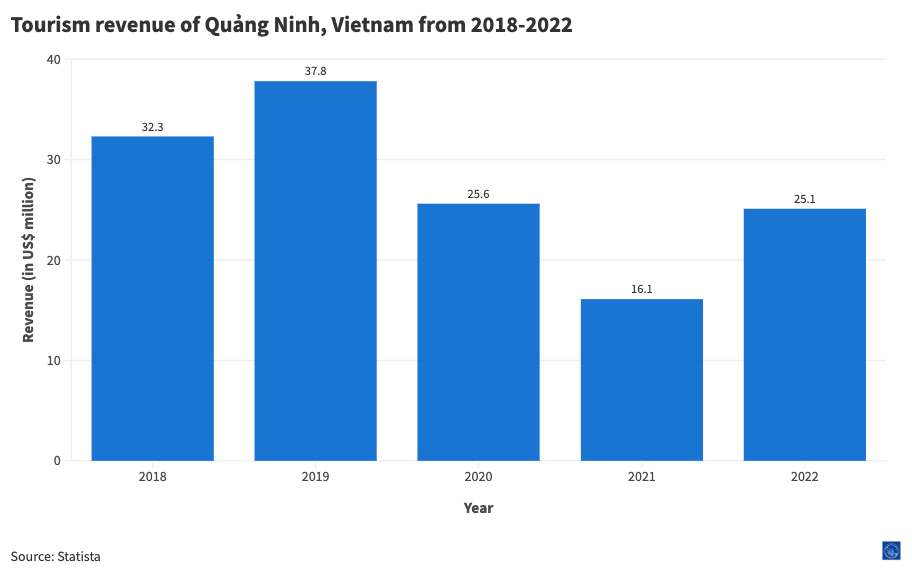

Case in point: 70% of Chinese visitors to Vietnam’s Quang Ninh province visit via road transport through Mong Cai’s border gate. In 2016, the Vietnamese border city of Mong Cai received one million visitors from China. That number has ballooned to 4 million people this year.

Also, transborder shipments between Mong Cai and Dongxing, which have been on the rise since 2015, were so important that operations resumed just months after a brief closure due to the onset of COVID-19 in 2020.

The Fangdong railway’s significance is clear: there could be a near-term tourism boom and opportunities to grow trade and local economies between Vietnam and China, if both sides play ball.

Why should I care?

Personally: A rail and logistics boom on the horizon

It’s also a boom time for rail development across Southeast Asia: over 80 - and nearly US$270 billion worth of investments - urban rail projects are in the pipeline already, and slightly over half of them will be completed by 2027.

Many of these projects are currently handled by high-speed rail specialists from Japan and China.

Even though ASEAN has stressed railway development as a means towards growth and regional integration, the expertise and talent needed to realize those outcomes still falls far short of expectations.

This could translate into higher salary packages for professionals that currently qualify, as well as opportunities in growing these talents.

Additionally, stronger rail integrations across Southeast Asia can also make local logistics more efficient and improve business margins in turn.

Case in point: The Chinese-built Boten - Vientiane railway in Laos reduced transport costs through the country by 30% to 40% relative to truck transport.

The bigger picture: Testing Vietnam’s foreign policy or maintaining “comradeship & brotherhood”?

While China reaffirmed its commitment to building a “shared future” - and signing off on 37 deals - with Vietnam, one topic remains unsettled: the Kunming - Haiphong railway.

The railway, built by the French, remains in the planning stage despite having appeared on every diplomatic declaration between Beijing and Hanoi since 2015.

The Kunming-Haiphong railway’s fate is symptomatic of Vietnam’s traditional apprehension towards Chinese initiatives. Taken in this context, Hanoi’s stance on the Fangdong railway is surprising, and has invited different interpretations.

On the one hand, some views allege that the Fangdong railway is a Chinese ploy to exploit Vietnamese rare mineral deposits, and an attempt to strong-arm Hanoi into giving Beijing what it wants.

On the other hand, Chinese media has painted the development as an attempt to promote cooperation between two countries that historically shared “comradeship and brotherhood.”

Community feature

Grab-affiliated think tank Tech for Good Institute has recently published a report titled “ASEAN Digital Economy Framework Agreement: Unlocking Southeast Asia’s Potential.”

Examining the importance of the framework, the report highlights the growth potential of Southeast Asia’s digital economy, and outlines key steps to ensure that growth is realized.

Read the full report here.

News roundup

Vietnam’s Ha Long Bay is grappling with over-development and pollution. Unabated, overtourism and the prevalence of illegal waste discharge and near-shore construction could ruin the renowned natural attraction and dent the country’s tourism boom.

Philippines president Ferdinand Marcos Jr. has extended tariff cuts on imported rice till the end of 2024. The move, intended to mitigate rising prices, is deeply contentious to local farmers.

Indonesian presidential candidate Prabowo Subianto and his running mate Gibran Rakabuming Raka will consider a tax on the country’s small and medium enterprises (SMEs) to boost state revenue if elected. Presently, SMEs enjoy a 50% reduction from the standard rate of 22%.

Vietnam has estimated a decline in Tet bonuses across all provinces for 2024. The wide variance in bonuses also hints at the growing wealth divide, evidenced by the growing Khoe Khoang trend among young, successful urbanites in the country.

Indonesia saw hundreds of workers protest against hazardous working conditions at a Chinese-funded nickel processing plant in Morowali Industrial Park. Earlier, an explosion at the plant killed at least 18 people and injured several more.