Deep Dive: A look at Indonesia's 2024 Elections

An overview of the key details, and expert insight from a think-tank analyst.

Published weekly, SEAmplified’s Deep Dive features longform analysis on a developing event or issue in Southeast Asia.

❗In Focus: Indonesia's 2024 Presidential Elections - Part 1 On Feb 14, 2024, 205 million voters will head to the ballot box as Indonesia, the world’s third largest democracy, chooses its next president.

This election is, in part, an evaluation of incumbent president Joko Widodo’s legacy. Joko Widodo’s, or Jokowi as he is commonly called in Indonesia, popularity soared past the support that won him a landslide victory in 2014, his position in Indonesian politics has also gradually shifted from populist outsider to unparalleled power broker.

But the election is also not free from authoritarianism's long shadow in Indonesia, nor the political relationships that defined the Suharto regime. Jokowi came to power by portraying himself as someone removed from the political elite. But allegations that his administration engages in the same nepotistic strategies that have defined Indonesian politics over the last two decades abound.

For Indonesia, the election is a pivotal moment not only for its economy but also for its democracy. This election, by virtue of Indonesia’s economic gravitas, will send ripples across Southeast Asia’s business and political landscapes.

Who’s gunning for Indonesia’s top seat?

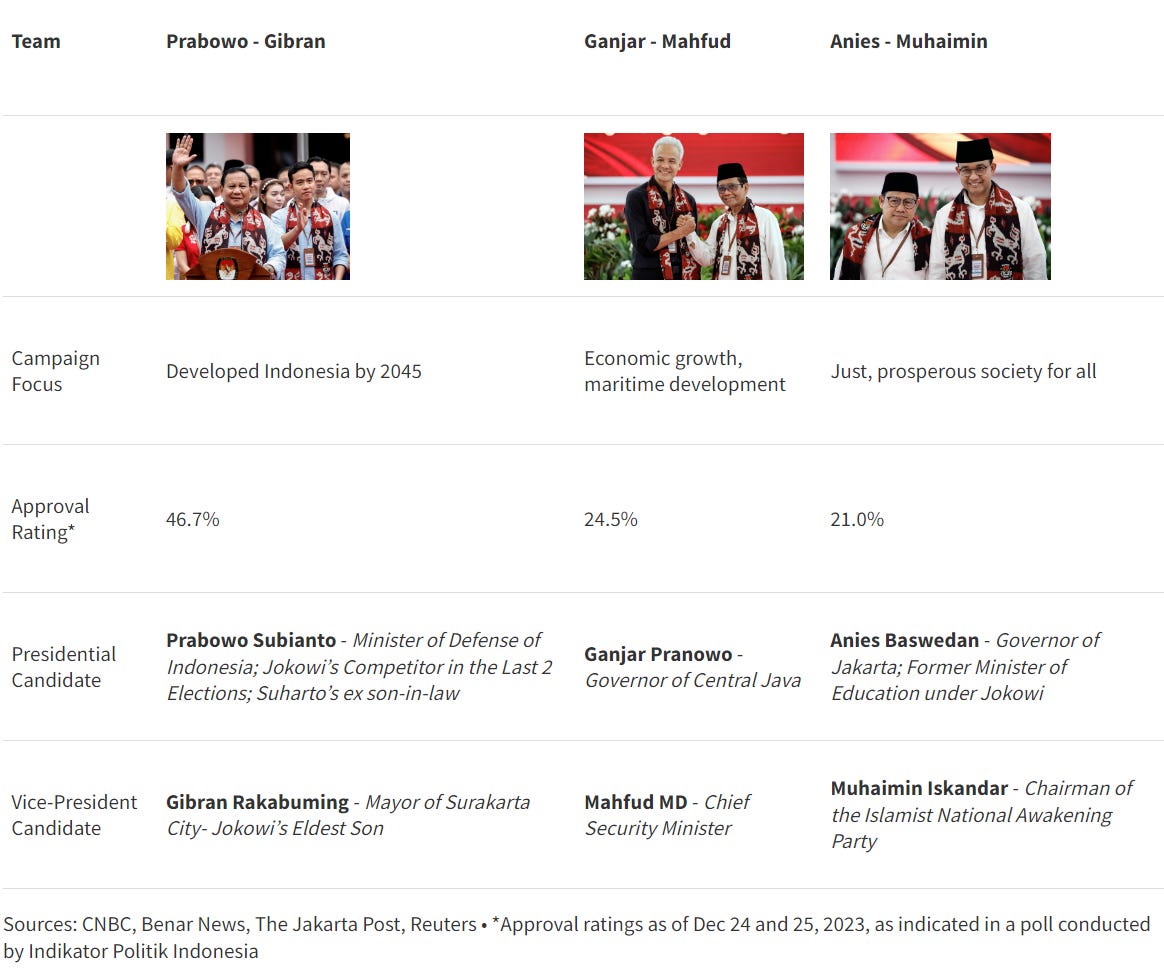

So, who are the contenders vying for the presidency in this election?

It is interesting to note that Gibran, who is the eldest son of Jokowi, is running under a different party’s banner from his father. This is apparently due to a rift between Jokowi and party chair Megawati Sukarnoputri, which arose because the latter did not consult Jokowi in the selection process for the next presidential candidate.

What are the candidates’ stances on key indicators and topics?

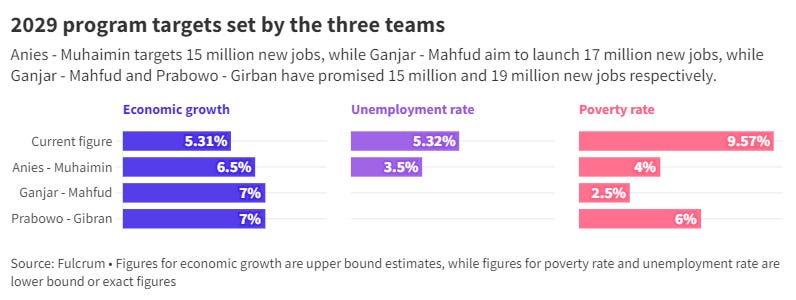

With bread-and-butter issues front and center in this election, each team has announced a set of economic targets to achieve by 2029:

Ganjar - Mahfud and Prabowo - Gibran did not specify an unemployment rate figure, though the former has outlined 21 flagship programs under the “Sat Set” movement that aims to achieve an economic growth rate of seven percent and generate 17 million new jobs.

Lowering Indonesia’s unemployment rate is also imperative to winning the youth vote, given that the country’s youth unemployment rate is a whopping 13%, nearly three percentage points above the regional average in 2022.

Achieving poverty rate targets could prove challenging in light of Jokowi’s Omnibus Law. Introduced in March 2023, it removed several guardrails for worker protection, including minimum wages, maternity benefits, and legal protections in permanent employee contracts.

As of February 2023, the average monthly net wage of Indonesian employees stood at US$189.70 - far lower than the average cost of living.

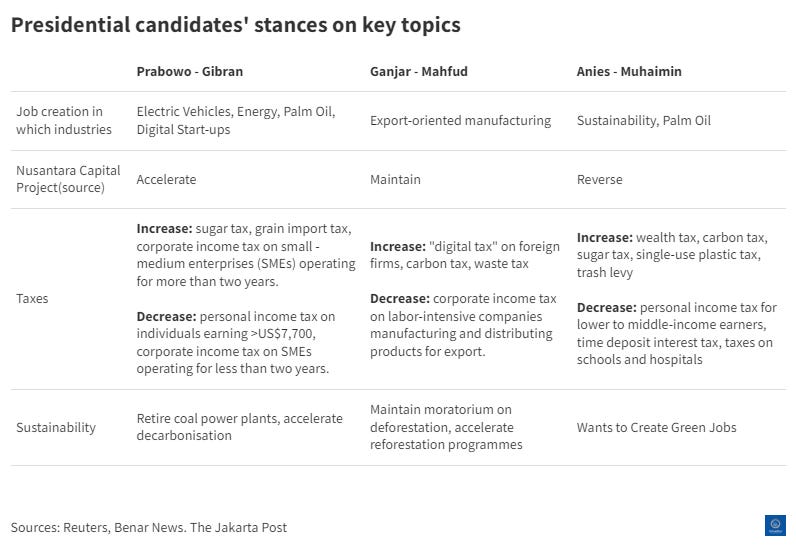

Additionally , each team has also espoused different takes on key election topics:

💡Why create jobs in those specific industries?

📌 Palm oil: Indonesia’s palm oil industry comprises 4.5% of Indonesia’s GDP but employs nearly 10.4% of its population.

📌 Export-oriented manufacturing: Indonesia’s manufacturing sector comprised a hefty 18.3% of the country’s GDP, and employed roughly 14% of its workforce in 2022. Ganjar plans to improve Indonesia’s export competitiveness and accelerate the country’s economic growth by doubling down on maritime infrastructure, but stopped short of specifying exact areas of investment.

📌 Cleantech: Includes renewables and electric vehicles (EV). Indonesia aims to cut carbon emissions from 350 million to 250 million metric tons by 2030, and wants to become a globally competitive EV supply chain player. Advocating for EVs also supports Indonesia’s mining and quarrying industry, which received the highest volume of foreign direct investment in 2022.

What’s at stake in 2024?

As Indonesia decides on its next president on February 14, all eyes will be on how the new leader takes the country forward and whether Jokowi’s legacy will be continued.

Certainly, job creation is top of mind for most Indonesian youths, and Indonesia has a shrinking window to leverage its demographic dividend, which is expected to peak between now and 2030.

More importantly, 2024 may be Indonesia’s moment to avoid the middle income trap. How Indonesia’s economy develops will also impact Southeast Asia’s economic prospects. This development will be key in determining whether the ASEAN bloc will truly become the world’s fourth-largest economy by 2030.