#7: Government pensions and Chinese no-shows

Malaysia scraps pensions for new civil servants, while an airport redevelopment bid in the Philippines counts no Chinese bidder.

Welcome to this week’s edition of SEAmplified! Your latest insights on Southeast Asian politics in 7.3 minutes.

As Tuesday, February 13th, 2024, is an off-in-lieu holiday in Singapore, we have decided to publish this edition a day later instead.

⌛This week in brief:

📌 Malaysia scraps pensions for new civil servants

📌 Manila airport redevelopment bid counts zero Chinese companies 📅 Explainer of the week

Civil service: Malaysia plans to scrap pensions for new civil servants

📌 Malaysia plans to abolish a pension scheme for new civil servants.

📌 The plan will relive the government of financial challenges, but it has been accused of sidelining ethnic Malays that make up the majority of the workforce.

📌 Civil service unions have protested against the decision amidst low salaries in the sector, while it has been dubbed as a much-needed and challenging reform by economists and politicians respectively.What’s going on here?

Malaysia plans to abolish a pension scheme for new civil servants to prevent bankruptcy, as an increase in retirees has led to increasing pension payouts, which have tripled from RM11.5 billion (US$2.2 billion) in 2010 to RM31 billion (US$6.5 billion) in 2023.

Instead, new civil servants will contribute to their Employees Provident Fund (EPF) account, a compulsory retirement fund.

What does this mean?

The Malaysian civil service currently employs about 1.7 million people, with Malays accounting for 90% of the workforce.

It also has roughly 900,000 retirees on the pension system, of which 71% are Malays, followed by the ethnic Chinese and Indians at 13% and 7.8% respectively.

With Malays dominating the sector, the government had to dismiss allegations of victimising the Malays. It stressed that since the 1990s, there has been no effort by previous governments to implement the policy.

At the same time, the government is facing financial challenges.

Malaysia’s total debt reached RM 1.45 trillion, or 80.9% of its GDP, dubbed by economists as unsustainable.

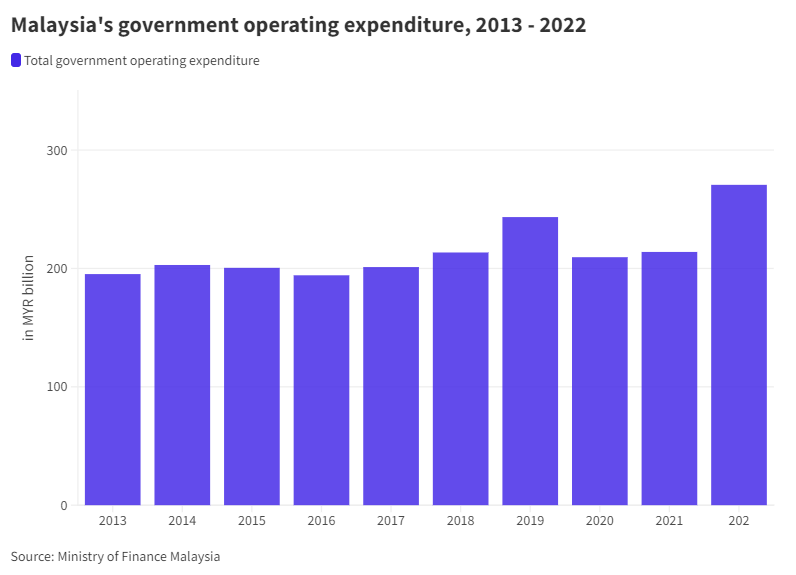

The government’s operating expenditure has increased, from RM211 billion (US$44 billion) in 2013 to RM292 billion (US$61 billion) in 2022.

If the current scheme is not abolished, authorities will have to spend RM120 billion (US$25 billion) to fund the pension scheme by 2040, which translates to 40% of the government’s expenditure in 2022.

Why should I care?

Personally: Dimmer prospects for the Malaysian civil service?

The pension system is an attracting factor for people to join the civil service, given lower salaries as compared to the private sector.

Civil servants earn an annual average salary of US$12,092, as compared to US$21,547 for managers in the private sector.

Spouse and children of civil servants can benefit from the scheme if they happen to die while in service.

However, the plan has faced scrutiny from civil service unions.

A congress of union of civil servants (CUEPACS) is against the plan, citing low salaries in the sector, and argued that the government should not remove any current benefits that civil servants enjoy, which includes the pension scheme.

A staff union for Malaysian universities argued that removing the pension system would leave nothing for them, while a Muslim teachers association has suggested that the plan would entice more people to join the private sector instead.

The bigger picture: A much-needed, but politically challenging reform?

With ethnic Malays dominating the civil service, politicians have suggested that the pension reform is a politically challenging move.

Former Democratic Action Party (DAP) leader suggests that the civil service serves the Malay political elite and it will be difficult to implement any reforms to it.

In Malaysia, the special position and rights of ethnic Malays are protected in the constitution, and they wield significant political power in the country.

However, economists have voiced their support to the plan.

They pointed out that the current pension scheme will prevent funds from being used on other programmes as the country faces an increasingly ageing population, with a seventh of the population reaching age 60 and above by 2030.

📅 Explainer of the week

Aviation, Infrastructure, Tourism, Military: In Manila Airport redevelopment bid, Chinese companies are conspicuously absent.

📌 India’s GMR Group currently leads Manila’s airport redevelopment bid.

📌 The decision suggests a departure from an earlier emphasis on bilateral ties, and hints at India’s growing presence in the Philippines.

📌 India’s growing interest in Southeast Asia could offer countries in the region an opportunity to rebalance, though most have opted to forge closer ties with China.What’s going on here?

Manila plans to award a US$3 billion contract to revamp its airport, aiming to enhance the facility after two unsuccessful expansion efforts. India’s GMR Group leads among four private bidders.

Chinese infrastructure companies are not among the qualified bidders, despite the previous administration’s push for Chinese investment in Philippine infrastructure, as well as a slew of bilateral agreements signed by incumbent president Ferdinand Marcos Jr. during his visit to Beijing in 2023.

The decision comes amid growing tensions between Beijing and Manila in the South China Sea, though it’s unclear if these tensions affected the bidding process.

What does this mean?

What’s clear is that Manila is awarding infrastructure projects on the basis of bilateral ties:

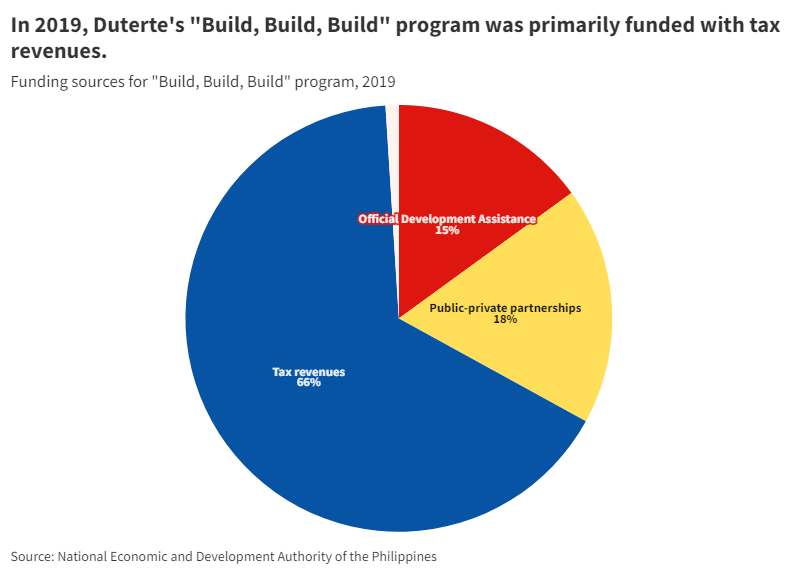

Previously, the Duterte administration’s “Build, Build, Build” program claimed to have nearly US$24 billion in total funding pledged by Chinese companies - nearly 13% to 15% of the overall budget that the administration intended to spend on the program in the medium term.

In October 2023, Manila no longer sought Chinese financial backing for three railway projects. The Philippines also pulled out of China’s Belt-Road Initiative a month later.

GMR Group’s lead also hints at India’s growing economic and defense interests in The Philippines:

Both countries were negotiating a bilateral preferential trade agreement in November 2023. The agreement would eliminate or reduce tariffs on various goods and strengthen trade cooperation between the two countries.

Aviation is an industry that’s significant to national security, and The Philippines has also ramped up military equipment purchases from Indian companies in recent years.

Why should I care?

Personally: Will Indian capital create new jobs?

The Philippines isn’t the only Southeast Asian country benefiting from an inflow of Indian capital and expertise. As India’s presence grows across the region, long-term job creation could be on the horizon:

Case in point: thousands of jobs could be created in Vietnam over the next decade as India’s Adani Group mulls a potential US$10 billion investment into the country’s infrastructure and renewable energy projects.

Bilateral trade between India and Singapore has also more than quadrupled to US$35.6 billion between 2005 and 2023, and the city state is a hotspot of Indian companies and investors looking to establish an office in Southeast Asia.

The bigger picture: A new rebalancing on the horizon?

As geopolitical tensions with China continue to flare, countries worldwide are gradually reducing their exposure to the Chinese market.

Japan, South Korea, and the US have scaled back trade reliance on China as the trade war between China and the US continues to escalate.

The ASEAN bloc’s share of the value of US imports also rose by 3%, while China’s share fell by 4% between 2018 and 2022.

ASEAN is also becoming a popular China + 1 destination for companies looking to diversify their supply chain and manufacturing activities beyond China.

That said, many Southeast Asian countries have gravitated closer, rather than further away, to China:

Chinese capital played an integral part in not only driving Jokowi’s Downstreaming policy forward in Indonesia, but also potentially fund the construction of Indonesia’s new capital Nusantara.

As of 2023, China was also the country with the highest investment value in Cambodia and Laos.

Community feature

It’s election day in Indonesia, but not every political party in the country is feeling the euphoria.

As In-depth Creative founder and seasoned political risk consultant Shawn Corrigan points out, 18 political parties will be competing for 580 seats in parliament. Parties need at least 4% to secure a seat, but Shawn estimates that nearly half of the parties in the race will fail to meet this threshold.

That’s not the only hot take Shawn has. From Indonesia’s electric vehicle ambitions to Indomie, his Linkedin shorts reveal hidden insights you won’t find in the mainstream media.

News Roundup

Malaysian pharmacies are selling prescription drugs two to fivefold cheaper than their Singaporean counterparts. As price wars erupt due to fierce local competition, some Malaysian pharmacies are engaging in illegal sales.

Indonesia’s coffee and cigarette industries are seeing a spike in demand for their products during election season. Producers attribute the boom to an increase in social gatherings, such as political rallies.

Vietnam has won a bid to export nearly 400,000 metric tons of rice to Indonesia, roughly 13% of the latter’s import quota this year. The shipment is expected to shield farmers from price slowdowns in Vietnamese rice exports.

Singapore has rolled out a Large Language Model (LLM) trained in Southeast Asian languages and cultural norms. The LLM is the first in a family of models termed SEA-LION, which sources 13% of its data from Southeast Asian languages.

Singapore-headquartered Grab and Indonesian superapp GoTo have restarted talks for a merger. A deal could reverse their fortunes, but consumers - and regulators - are spooked by fears of a potential virtual monopoly.