#6: Tourism recovery and wage arbitrage

Tourists are back in force in Singapore, while Singaporeans seek respite from rising costs in Johor.

Welcome to this week’s edition of SEAmplified! Your latest insights on Southeast Asian politics in 7.8 minutes.

⌛This week in brief:

📌 Singapore's strong tourism recovery in 2023

📌 An influx of Singaporeans moving to Johor unsettles the locals 📅 Explainer of the week

Tourism: Singapore’s tourism industry sees strong recovery in 2023

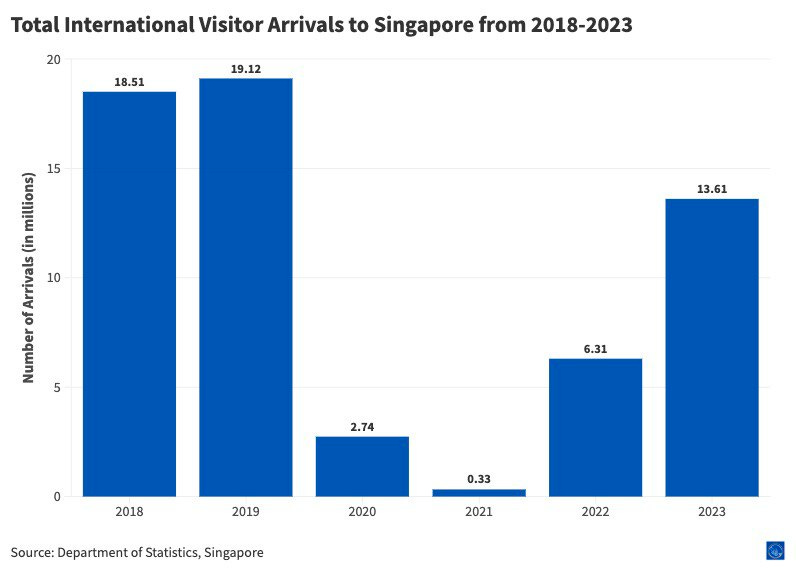

📌 Foreign visitor arrivals into Singapore reached 13.6 million in 2023, signaling a recovery in Singapore’s tourism industry after Covid-19.

📌 The tourism industry has a broad impact in Singapore, as tourist dollars flow into key industries including hospitality and consumer retail.

📌 Southeast Asia is attracting Chinese and Indian tourists with visa-free initiatives and marketing, but the industry is staying cautious amidst changing travel patterns, inflation, and geopolitical disruptions.What’s going on here?

Singapore welcomed 13.6 million visitors in 2023, hitting the government’s forecast of 12 to 14 million visitors. It signals a recovery in the city-state’s tourism industry which was battered by Covid-19.

What does this mean?

While tourism comprises about 4% of Singapore’s GDP from 2010-2019, it has wide-ranging impacts on its economy.

Foreign visitors spend their money on accommodation, food & beverage (F&B), and shopping in Singapore, of which 24% to 52% of their money are spent in hotspots like Marina Bay and Orchard Road.

Visitors also spend at least 40% of their time near their hotels. Retail and F&B outlets in such locations are likely to benefit from them.

Tourism spending would support employees in industries like accommodation, and F&B, in varying degrees.

In 2019, 30% of accommodation revenue and 31% of retail revenue was generated from tourists.

About 31% of Singapore residents were employed in tourism-related industries in 2019.

Unfortunately, Covid-19 resulted in heavy job losses.

Accommodation: Resorts World Sentosa laid off 2,000 out of 7,000 employees, while a hotel group axed 15% of its Singapore workforce.

Transport: Singapore Airlines retrenched 9% of its workforce in Singapore and overseas.

Singapore lifted all border restrictions in February 2023. This could explain the jump in foreign arrivals in 2023 as compared to previous years.

Why should I care?

Personally: A travel boom into Singapore

The lifting of border restrictions led to the resumption of travel and increased international flights into Singapore.

Singapore Changi Airport handled 58.9 million passengers in 2023, up from 32.2 million in 2022, and restored 90% of its pre-pandemic city links.

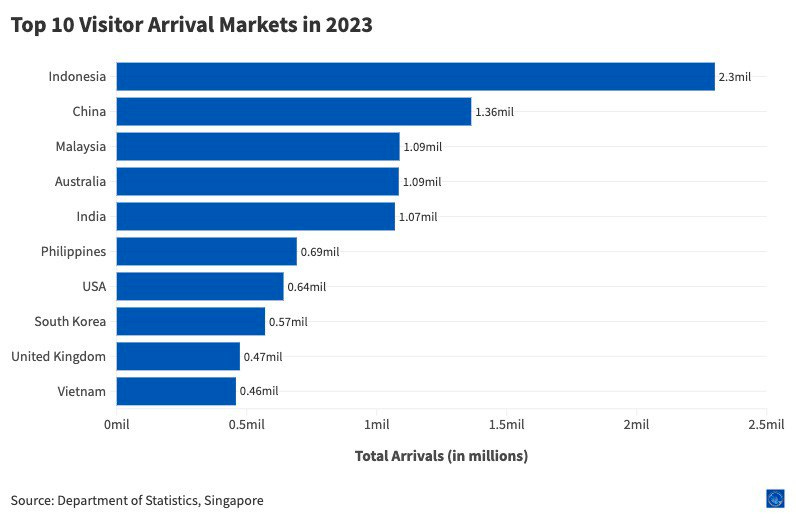

China, India, and Indonesia are among the top ten markets by number of visitor arrivals in 2023.

The government also made efforts to support the recovery of the industry.

New business events, hotel investments, and an agreement for Disney Adventures cruise to call Singapore home for five years starting in 2025 were secured.

A “Made in Singapore” global campaign was launched in 2023 to attract more travelers to visit Singapore.

The bigger picture: A cross-border tourism boom across SEA?

Recently, Singapore and China reached a mutual 30-day visa-free agreement that begins on Feb 9.

Following the announcement, online searches for travel to Singapore shot up by 350%.

With Malaysia and Thailand also offering visa-free arrangements to Chinese tourists, more are expected to embark on “Singapore-Malaysia-Thailand” tours, with bookings to the region reportedly up by 15 times year-on-year.

Singapore and regional countries are trying to capture more Indian tourists, given that 5 million Indians visited SEA in 2019.

While Singapore attracted 1.1 million Indian tourists in 2023, it is collaborating with airlines and travel partners to attract more to the city-state.

Malaysia and Thailand granted Indian passport holders a 30-day visa-free since 2023. Online flight searches for Bangkok and Kuala Lumpur spiked by 1.42 and 2.2 times on a travel website respectively.

Vietnam, which welcomed 278,000 Indian tourists in the first nine months of 2023, is also considering visa-free arrangements for Indian travelers.

However, the tourism industry is staying cautious in 2024.

Economic and geopolitical concerns like inflation and disruptions may encourage tourists to travel closer to home and seek value for money.

These factors may hamper travel recovery efforts, as Singapore seeks to intensify efforts to create new travel experiences for travelers.

📅 Explainer of the week

Real estate, construction, remote work: Singaporeans seek cost-friendly respite in Johor Bahru, but locals struggle with gentrification

📌 Singaporeans are flocking over the causeway in search of homes, as rising rents and living costs depress spending power.

📌 The influx could reverse the fortunes of Johor’s higher-end development projects, which previously relied on foreign buyers.

📌 Johor’s situation resembles other Southeast Asian cities popular with digital nomads, where rich foreign communities are slowly gentrifying local neighborhoods. What’s going on here?

As rental and living costs soar in Singapore, more Singaporeans are opting to stay in the Malaysian city of Johor Bahru.

The influx of Singaporeans has reinvigorated Johor Bahru’s real estate sector, which saw demand from affluent foreign buyers slump during COVID-19.

Quicker QR code border checks and a new RTS rail link that can handle 10,000 commuters per hour promise to make traveling between Singapore and Johor Bahru more convenient.

A proposed Johor - Singapore Special Economic Zone also incentivises Singaporean businesses to establish themselves in Johor Bahru.

Changes in work culture and remote working also enable Singaporeans to consider living in Johor Bahru while working in Singapore as a viable option.

What does this mean?

Housing’s feeling too pricey in the Lion City.

Nearly 53% of 1,036 Singaporeans surveyed by real estate platform PropertyGuru planned to defer home purchases in H2 2023 until inflation eases, while 24% of them put off home purchases.

Nonetheless, conventional measures suggest that public housing in Singapore remains relatively “affordable”. Singaporeans’ anxieties remain significant, given the Singapore government’s efforts to curb real estate speculation from investors.

That’s a huge push factor for many Singaporeans moving across the causeway, who are enabled to do so by a strong acceptance of remote work:

Seven in 10 organizations based in Singapore allow employees varying flexibility in where they choose to work.

Between June 2022 and June 2023, 73% of Singaporeans indicated a strong preference for a hybrid work model

The rise in demand for housing in Johor Bahru is clearing off unsold inventory among the city’s real estate developers:

Unsold residential units in the state of Johor totalled 4,700 units worth RM 4 billion (US$1.1 billion). That’s almost one in five of all unsold apartments in Malaysia by unit and value.

Why should I care?

Personally: New opportunities for wage arbitrage

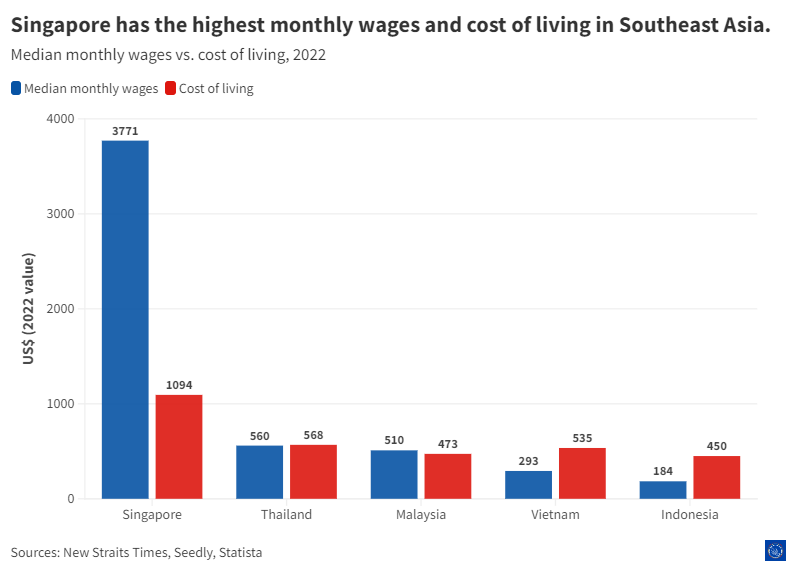

Living costs and wages differ widely across Southeast Asia.

Businesses in Singapore can grow their operations without driving up their costs too high by hiring talent based in other Southeast Asian markets where wages are lower.

Conversely, highly mobile talent whose occupations are location-independent can also leverage lower living costs in emerging Southeast Asian markets, or better-paying opportunities in more developed ones.

Such wage arbitrage opportunities across Southeast Asia also attract talent outside of the region, with cities such as Penang, Kuala Lumpur, Da Nang, Hanoi, and Ho Chi Minh city quickly emerging as popular digital nomad destinations.

The bigger picture: As gentrification looms, will affluent foreigners become the new bogeyman?

Having too much of a good thing can be a bad thing, and that goes with foreign buyers and skilled talent as well.

Case in point: gentrification, or the process in which the character of a local area is changed due to the arrival of more affluent residents and investment, is slowly creeping in across many Southeast Asian cities.

In Hanoi for example, gated communities and luxury high-rises began emerging in the city’s famous Old Quarter as early as 2016. Over in Penang, gentrification is threatening the prospects of traditional jetty houses and the communities that call them home.

As more high-rise condominiums emerge, local Johoreans, or “Anak Johor”, not only feel that their unique identity and heritage are at risk of being lost, but are also concerned that the influx of Singaporeans is also causing local prices to skyrocket.

Community feature

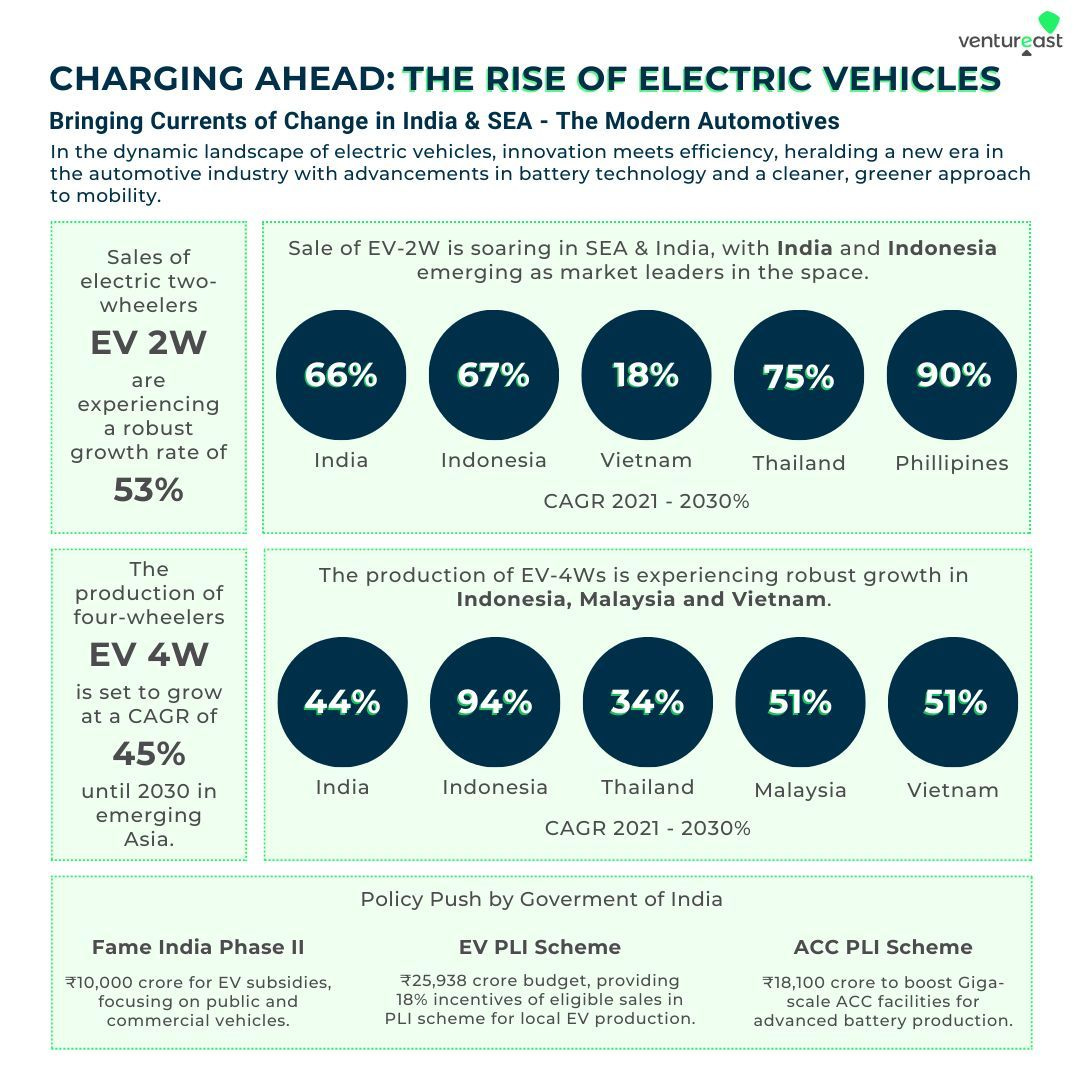

Southeast Asia’s electric vehicle market (EV) is booming, with various estimates suggesting double-digit growth rates at least until 2035. Indonesia is poised to be the region’s largest EV market, and that prospect isn’t lost on the country’s leaders.

This view is reiterated in a new report from Indian venture capital firm Ventureast and Singapore-based Golden Gate Ventures, which also highlights other bright spots in climate technology such as waste management and climate accounting.

What’s in it for working folks? Jobs, and presumably lots of them. A separate take by Singapore-based nonprofit Bridgespan suggests that the sustainability boom could create nearly 30 million jobs in Southeast Asia by 2030.

Read and download the full report from Ventureast and Golden Gate Ventures here.

News Roundup

Thailand is encouraging companies to buy garlic and onions, among other crops and poultry products, from farming areas. The initiative also encourages companies to purchase fresh produce that may look less than perfect due to the changing weather.

Singapore is expected to take on a more significant role in the global semiconductor supply chain as demand from the global automotive industry rises. In 2022, the country was the third largest exporter of electronic integrated circuits.

Singapore has maintained its rank as the fifth least corrupt country in the world, and remains the only Asian country among the top 10 since Corruption Perceptions Index’s (CPI) publication in 1995.

Indonesia’s Java province is expected to report a lower rice harvest due to abnormally dry weather. Rice prices in the country are almost 16% higher year-on-year.

Philippines president Ferdinand Marcos Jr and his predecessor Rodrigo Duterte are locked in an increasingly heated feud. The rift could ruin the alliance that helped Marcos Jr and current vice-president Sara Duterte (Rodrigo Duterte’s daughter) win the 2022 election.