#5: Tax hikes and export gloom

Indonesia postpones a controversial tax hike, while Thailand sees weak export recovery.

Welcome to this week’s edition of SEAmplified! Your latest insights on Southeast Asian politics in 7.3 minutes.

⌛This week in brief:

📌 Indonesia backtracks on an entertainment tax hike

📌 Thai exports grow for fifth-straight month, misses forecasts 📅 Explainer of the week

Energy: Tourism, Entertainment: Indonesia postpones entertainment tax hike following industry backlash

📌 Indonesia is postponing a controversial entertainment tax hike, following protests and legal action from entertainment and tourism businesses.

📌 Despite reassurances, the Indonesian government has been accused of drafting the tax hike law without consulting industry players.

📌 The proposed tax hike has dissuaded visits to clubs, karaokes, and the popular resort island of Bali, and comes amid the run-up to the presidential elections.What’s going on here?

Indonesia’s government is postponing a 40% to 75% entertainment tax policy amid backlash from the country’s tourism industry, which fears that the move will dampen a post-COVID recovery.

What does this mean?

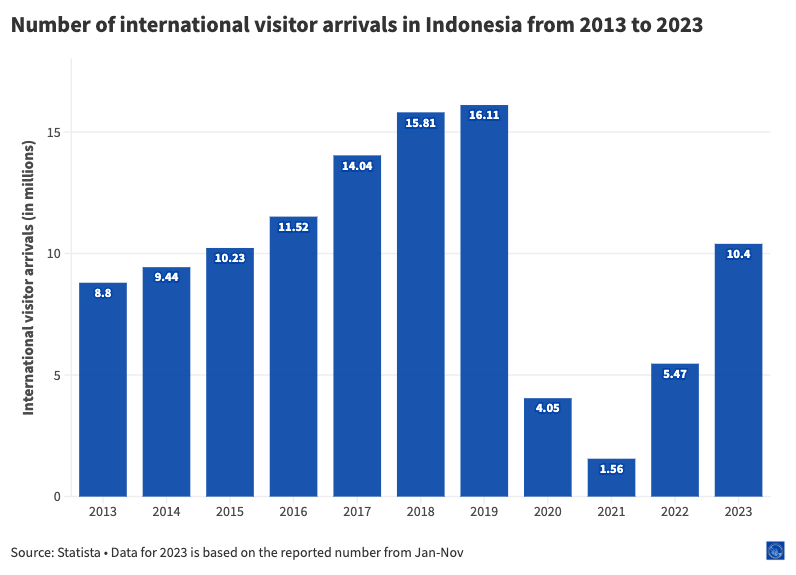

Indonesia aims to attract 14 million tourists this year, following a steady recovery from the Covid-19 pandemic.

The country recorded 10.4 million foreign visitor arrivals from January 2023 to November 2023, albeit lower than pre-pandemic levels.

Early this month, the government decided to impose a national entertainment tax rate of 40% to 75%, based on a 2022 fiscal relations law that regulates financial relations between the central and regional governments.

On Jan 5, the Jakarta government increased the entertainment tax to 40%, up from 25% for nightclubs, and bars, and 35% for massage parlors and spas.

Other regions like Banda Aceh and Depok imposed a 75% tax rate before the new policy was announced.

In response, the tourism industry protested against the tax hike.

The Indonesian Tourism Industry Board has rejected and refused to abide by the new tax hike. They criticized the government for not consulting the industry when drafting the 2022 law.

Meanwhile, the Association of Spa & Wellness Indonesia has decided to file a lawsuit with the Constitutional Court, asking for a review of the 2022 law.

There are also concerns that the tax hike could ruin Indonesia’s top destination Bali, leading to a decline in tourist numbers and resulting in the collapse of the local economy, where 60% of the local population depends on tourism.

Why should I care?

Personally: A slump for Indonesia’s tourism industry, and a boom for other countries?

The proposed tax hike has begun to dissuade locals and tourists from visiting entertainment venues like nightclubs, karaoke, and Bali, which could disrupt the industry in Indonesia.

The price of a cocktail at a club would increase from IDR 200,000 (US$12.63) to IDR 350,000 (US$22.19), and this might dissuade people from frequenting clubs.

An Australian tourist’s photo of how two bottles of 380ml mineral water at a bar cost IDR 240,000 (US$15.21) sparked a debate over Bali’s high cost for travellers.

If a 40% tax hike is applied, the price may increase to IDR 336,000 (US$21.30). In contrast, two bottles of 330ml mineral water at a local convenience store cost an average of IDR 6,000 (US$0.38).

Tourists are complaining about how Bali is no longer affordable, and the tax hike could further dissuade tourists from visiting the popular resort island.

Meanwhile, neighboring Thailand approved a tax cut from 10% to 5% on entertainment venues to boost tourism, a move that could attract tourists away from Indonesia.

The bigger picture: Give us our jobs

The proposed tax hike could hinder job creation aims set by all three presidential candidates, and cast some teams in a negative light.

Indonesia’s tourism arrivals in 2023 had not reached the same levels as 2019, and increased costs from the tax hike could severely slow down a rebound.

Still, the impact of the tax hike on overall job creation could be mitigated by the fact that tourism accounted for just 4.1% of Indonesia’s GDP.

📅 Explainer of the week

Automotive, Agriculture, Ecommerce: Thai export growth misses forecast in Dec, small rise seen in 2024

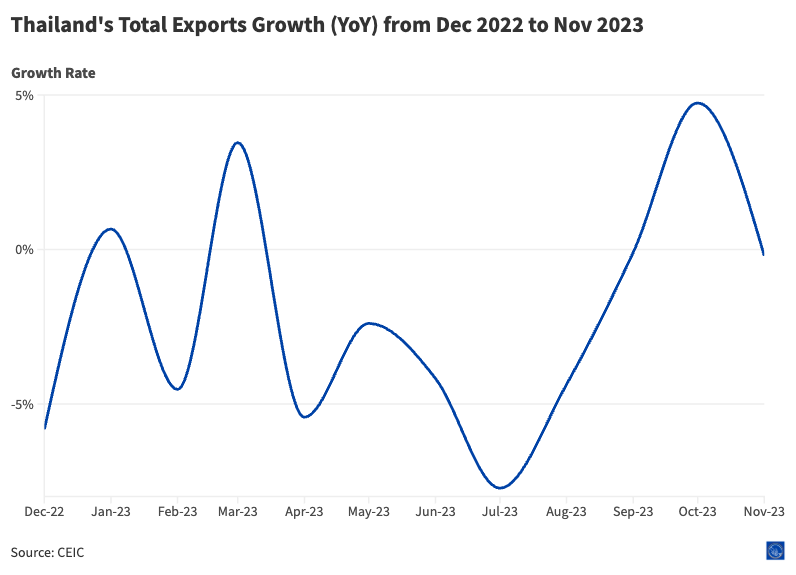

📌 Thailand’s export volume rose for a fifth-straight month, but it could take the country longer to recover from previous dips.

📌 The rebound could be a sign that Thailand’s strategy of developing new export markets and reinvigorating links with old ones is working.

📌 As global headwinds intensify, Thailand’s situation hints at a bigger need to diversify away from old growth sources. What’s going on here?

Thailand’s export volume have risen for a fifth straight month, but whole-year growth estimates suggest that it could take longer for the country’s export sector to recover from a dreary 2023.

Headwinds abound: issues like the Houthi crisis in the Red Sea and the ongoing Hamas-Israel conflict hinder global trade, while growing Sino-US tensions also have already bifurcated global supply chains.

Thailand’s export recovery is also hampered by the fact that China and Japan, its largest and second-largest trade partners, are in the economic doldrums.

That said, Thailand’s export recovery has been unequal. Chemical exports dipped in December last year, but products like cars and car parts, as well as rice, saw an increase.

What does this mean?

Thailand’s export sector accounts for nearly 60% of the country’s gross domestic product (GDP).

When exports slid for seven straight months in 2023, businesses and the government knew something had to be done, and it had to be done fast. The play: explore new markets, maintain existing markets, and revitalize old markets.

Maintaining existing markets, like China and Japan, has been tough: consumer spending remains low or has even declined. Thailand’s export rebound is likely due to growth in new markets like the Middle East and South Asia, as well as stronger demand in “old” markets like the ASEAN bloc.

Some Thai exports also saw stronger demand due to other big-picture concerns:

Thai rice export volumes, for example, rose 4.1% year-on-year in Dec 2023 due to global food security concerns.

Cars and car parts rose on the back of increased demand in markets like Australia and the US, which saw prolonged automotive supply shortages during COVID-19.

Why should I care?

Personally: A cross-border commerce, logistics boom for SEA

With export headwinds going strong, Thailand and its Southeast Asian peers have turned to deepening trade with each other.

As of mid-2023, intra-ASEAN trade stood at 22.3%, up from 21.3% in 2021. While the uptick isn’t significant, it could suggest that Southeast Asian countries are cosying up to each other’s exports.

Market estimates also expect strong, continued growth in intra-ASEAN trade thanks to rising incomes in Indonesia, Malaysia, The Philippines, and Vietnam.

The cherry on top: Southeast Asia’s cross-border ecommerce is expected to grow from US$36.7 billion in 2022 and US$81.8 billion in 2027.

Will that translate into more jobs in cross-border physical and ecommerce? TikTok Shop is on a hiring spree in Singapore (a LinkedIn search yielded 57 results as of Jan 28, 2024), while logistics giants like DHL are pouring investments into creating jobs and infrastructure across the region.

The bigger picture: Diversify, diversify, diversify

The ASEAN bloc’s largest trading partner has varied between 2010 and 2023, but China has often emerged as the most dominant party.

In fact, China’s share of trade with ASEAN was nearly 20% by 2020. That’s a bit of a pickle, especially when China’s economy slows down.

It’s not just China in the economic doldrums. Consumers in other key ASEAN export markets like the EU are also tightening their belts due to inflation, and that has reduced demand for ASEAN exports.

The fix? Look to new markets. US$53 billion of trade remains unexplored between ASEAN and countries in the Middle East and North Africa; ASEAN trade with India also soared 23.4% from US$91.6 billion in 2021 to US$113 billion in 2022.

Southeast Asia is also seen as an ideal “China Plus One” destination, and countries across the region could cash in on businesses looking to diversify their supply chains in the wake of growing Sino-US tensions.

Community feature

2023 was the warmest year on record. As the forecast above by US-based climate consulting firm iScience shows, Southeast Asia certainly felt the heat.

The unusually warm weather has wreaked havoc on the region’s agriculture sector. Droughts have decimated rice harvests in several Indonesian provinces as well as in the Malaysian state of Kedah, which accounts for nearly 40% of Malaysia’s rice production. Over in Vietnam, a shortage of coffee has caused a surprise windfall for coffee farmers, while causing a headache to exporters and F&B operators.

News roundup

Thailand’s Bangkok-Nong Khai train service will extend its reach to the Vientiane by April 2024. The extension, serviced by two round trips daily, is expected to bring in larger numbers of foreign tourists from Bangkok to Vientiane.

Indonesians working in the oil, gas, and coal industries are pushing back against the country’s energy transition over unemployment and cost-of-living fears. Meanwhile, Indonesia’s government has also scaled back the country’s share of renewables in the national energy mix.

Philippines trade officials have come under fire for allowing manufacturers to reduce product sizes while keeping retail prices the same. Critics warn that the move does not address the pressure of rising living costs on low-income families.

Indonesian palm oil is riding a boom in demand. The commodity, already a crucial biofuel input, is seeing further uptake as industries and transportation pivot towards biodegradable, cleaner fuels.

Southeast Asian countries are targeting affluent Indian travellers in a bid to plug the gap left behind by their Chinese counterparts. Some countries plan to boost air connectivity with key Indian cities, as well as relax visa entry requirements for Indian travellers.